Powered by Inscritos Milionários

Powered by Inscritos Milionários

The Trader Token increases in value independently of external capital inflows due to its profit reinvestment process and token burning mechanism.

With the exponential growth of Trader Token and our consolidation as the largest Brazilian cryptocurrency today, we made our mark as a highlight at one of the biggest crypto events in the country! We gave a keynote, presented the project to the public, and showed the world our true potential. Brazil has seen it. Now it’s time for the world to know.

The project aims to enable semi-automatic self-appreciation through simultaneous trading operations in short, medium, and long term.

The volatility in the crypto market leads the Trader Token to increase its reinvestments in itself, generating token burns and scarcity.

The Trader Token has investment portfolios 100% focused on the cryptocurrency market, with purchases since early 2023.

Track real-time performance and trade Trader Token with ease and transparency.

Understand how we enhance the token's value through consistent actions to strengthen its ecosystem.

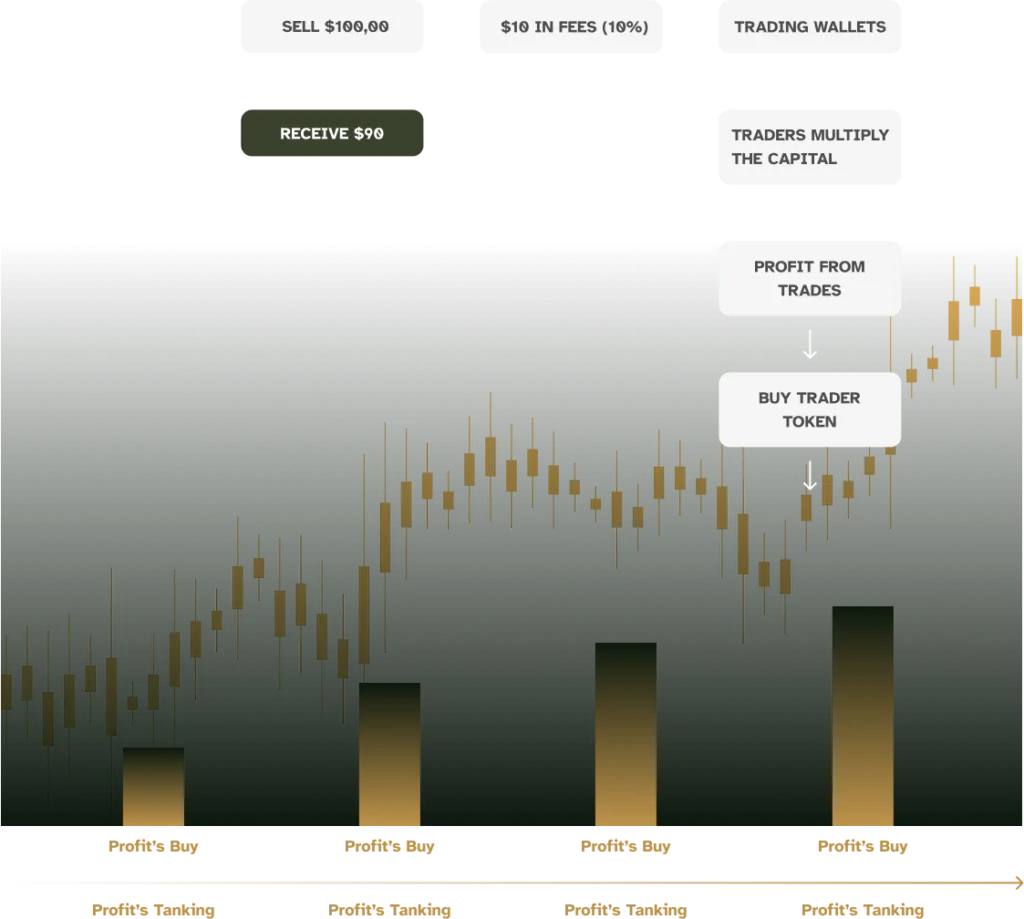

Trader Token employs a continuous buyback mechanism to increase its value and ensure the growth of its ecosystem. Here's how it works:

Transaction fees from the Trader Token are collected periodically.

These fees are used for holding positions, position trades, swing trades, and participation in airdrops, presales, and asset launches.

Profits are used to buy back Trader Tokens, burn them, reinvest in investment portfolios, and pay traders.

A clear and efficient cycle: from transaction fees to token appreciation.

Every month, Trader Token's profits are transformed into buybacks, burns, and direct payments to our traders. Join us live on Telegram and watch every cent invested gain value.

Burned tokens driving scarcity and appreciation

Total number of tokens repurchased in the last report

Next Live on Telegram

Max Total Supply | 1.000.000 TDE

Caixa TOTAL:

Check balances now

Trader Token (TDE) investment portfolios are about to reach the milestone of $70,000 in accumulated capital. This amount is the result of profits generated through strategic operations and consistent reinvestments since the beginning of the project.

Read more

The Trader Token (TDE) community continues to grow and has just surpassed 2,000 active members in the official Telegram group. This growth reflects the increasing interest in the project, driven by consistent results, transparency, and a strong social media presence. The group has been the main channel for updates, discussions, and direct interaction with the team.

Read more

April 2025 marked a new record in profitability for Trader Token (TDE). Operating exclusively with the swing trade account — which represents only 35% of the total capital — the project achieved its highest monthly profit since launch. This result reinforces the effectiveness of the adopted strategy and validates the model of reinvesting profits into the token chart, directly benefiting holders.

Read more

The audit of the Trader Token (TDE) contract by CertiK — one of the most respected blockchain security companies in the world — has officially begun. This is an important milestone for the project, aiming to strengthen community trust and attract institutional investors. The audit includes a complete smart contract analysis and team verification (KYC), with a public badge on the CertiK dashboard.

Read more

Trader (TDE) has just been officially listed on CoinGecko, one of the world's leading cryptocurrency price trackers. This achievement strengthens the project's legitimacy and significantly increases the token's international visibility. The listing on CoinGecko is a strategic step toward future listings on major exchanges, facilitating access for new investors and reinforcing TDE's institutional presence in the crypto market.

Read more

Parcerias and OTC investments. Choose a subject below or send us a message through the form.

Media kits, co-marketing, and integrations.

Private allocations and larger tickets.